Product Consultation

Your email address will not be published. Required fields are marked *

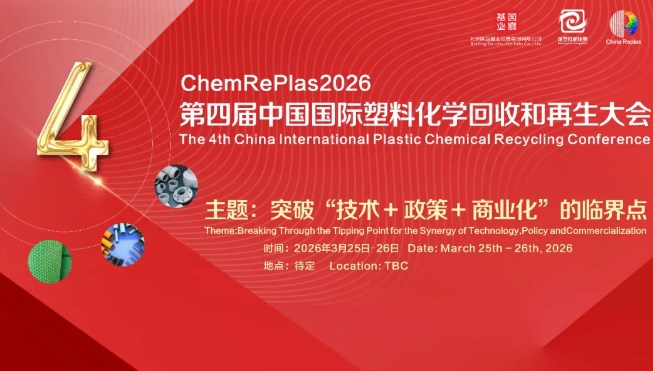

The 4th China International Plastics Chemical Recycling and Regeneration Conference

March 25-26, 2026

On December 2, 2025, the Plastics Recycling Branch of the China Synthetic Resin Association held the "2026 Symposium on the Business Situation of the Plastics Recycling Industry." At this crucial juncture between the conclusion of the 14th Five-Year Plan and the start of the 15th Five-Year Plan, facing multiple challenges such as declining raw material prices, rising costs, a complex international situation, and shrinking downstream demand, over 500 industry entrepreneurs and experts gathered online to jointly analyze the situation, share difficulties, and explore solutions.

1 — Bitterly cold wind: Profit margins almost gone

Intensified market competition is the primary impact. The massive expansion of the petrochemical and coal chemical industries has kept virgin material prices at historically low levels, severely squeezing the already meager cost advantage and profit margins of recycled plastics. Prices for some products are now lower than those for virgin materials, trapping companies in a vicious cycle where "taking orders results in meager profits or even losses, while not taking orders means stagnation."

Rising rigid costs further exacerbate the situation. High collection, sorting, and cleaning costs, coupled with a sharp decline in downstream orders, have put continuous pressure on procurement prices, sending a chill through the entire industry chain. Simultaneously, downstream demand is structurally shrinking. The relocation of manufacturing has led to a decrease in demand for basic raw materials, and under the influence of the domestic economic environment, large customers have extremely strong bargaining power, severely compressing the survival space of small and medium-sized enterprises.

2 — Panic Spreads: Entrepreneurs Speak of "Life or Death"

"This concerns the life or death of my company." This statement at the symposium expressed the sentiments of many attendees. The sense of crisis and uncertainty within the industry is at an all-time high.

Panic 1: The "Guerrilla Forces" Outnumber the "Staff." Bad money drives out good. Numerous unregulated small workshops operate with extremely low environmental, labor, and near-zero tax costs, making it impossible for compliant companies to compete. In some niche sectors, unregulated production capacity may account for one-third of total capacity, severely disrupting market order.

Panic 2: History Repeats Itself, Industry Undergoes Dramatic Consolidation. The current predicament and consolidation path of the plastic recycling industry are similar to the development trajectory of the lead-acid battery industry over the past 20 years: from thousands of companies to no more than 50, with 80% of production capacity concentrated in leading enterprises. Attendees judged that a drastic and inevitable industry reshuffle is imminent: ultimately leading to a new industrial ecosystem where "a few leading companies occupy the vast majority of the market share, with a group of distinctive supporting enterprises developing in synergy."

Panic 3: Policy Support "Much ado About Nothing." The industry is generally disappointed and frustrated by the slow implementation of policies. The core issue is the lack of mandatory requirements for the proportion of recycled materials added, preventing a genuine surge in market demand. The association also revealed that key policy documents have replaced "mandatory" with "encouraged," leaving the industry feeling powerless about relying on policy to drive demand.

3 — Transformation Paths: Three Directions Outlining the Industry's Future Survival Map

Despite the severe challenges, the insights and practices emerging from the conference pointed the industry towards explorable breakthroughs, outlining multiple paths to the future.

Path One: Vertical Integration, Building a Closed-Loop Moat. A successful business model was repeatedly mentioned: companies establishing a complete industrial chain from global recycling networks to refined processing and high-value-added consumer goods manufacturing. The core of this model is to move beyond positioning oneself as a primary raw material supplier and instead, by producing end-branded products (such as building materials and home furnishings), completely escape the "red ocean" of direct price competition with virgin materials.

Path Two: Technology-Driven, Opening Up New Value-Added Tracks For most companies, shifting towards high-tech barriers is crucial. The focus is on two frontiers: first, converting low-value mixed waste plastics into basic chemicals through chemical recycling; and second, deep purification technologies for specific categories (such as PP). These breakthroughs can achieve quality leaps and open up unique profit margins.

Path Three: Ecological Collaboration, From Individual Efforts to an Industrial Community. Faced with systemic challenges, the industry believes it needs to shift from "individual efforts" to "collaborative operations." By building industry chain alliances, sharing resources, facilities, and markets, a large-scale and standardized cluster force can be formed to jointly reduce costs, develop demand, and enhance overall resilience.

4 — Core Consensus: Driving Systemic Value Reassessment

The fundamental turnaround for the industry depends on changes in the external system environment, which has become the strongest common call at the meeting.

Primary Consensus: Policy is the "Demand Engine." The entire industry urgently needs to push for the national-level issuance of "mandatory usage ratios" and a clear timetable. Clear regulations are the core switch for creating stable domestic demand and driving investment; the prosperity of the EU market has validated this path. Industry organizations will actively gather frontline voices to promote policy implementation.

Core Direction: Directly Monetizing "Green" Achievements. Monetizing the carbon reduction value of recycled plastics is key to building a new profit pillar for the industry. It is understood that relevant carbon reduction methodologies have entered the approval process, and large state-owned enterprises are leading the construction of an industry-level carbon footprint accounting and trading system. In the future, environmental contributions will directly translate into "green income" for enterprises.

Realistic Choice: Integrating into Global and Leading Supply Chains. Going global has become an important option for diversifying risks and discovering undervalued opportunities. Meanwhile, downstream petrochemical giants and brand owners are actively investing in the circular economy, providing unprecedented strategic cooperation opportunities for recycling companies. Integrating into the green supply chain through technological cooperation or capacity binding can secure orders, funding, and a springboard for upgrades.

5 — Association Actions: Early Warning, Analysis, and Promotion.

Faced with industry challenges, the association is taking active measures:

Building Consensus and Conveying Frontline Voices: Holding industry symposiums to gather real-world data, formulate strong policy recommendations, and convey urgent demands for change to national ministries.

Analyzing Case Studies to Explore Survival Paths: The meeting focused on discussing different survival strategies, including integration, technological breakthroughs, and overseas expansion. The association will continue to explore and promote effective approaches to help companies navigate economic cycles.

Empowering with Tools to Improve Industry Efficiency: The association is leveraging technological tools to build an industry knowledge base and design support platform, aiming to reduce operational and innovation costs for businesses through digitalization.

Depth丨The closed-loop revolution of textiles: T2T opens a new era of high-value circulation

2025-11-28

From Raw Materials to Market: A Professional Guide to Super White Non-Woven Staple Fibers

2025-12-01Your email address will not be published. Required fields are marked *

Focusing to the research and production of differentiated fiber. Applying recycle-material processing scientifically.

Zhulinjizhen, Xinfeng Town, Jiaxing City, Zhejiang Province

Copyright @ 2023 Jiaxing Fuda Chemical Fiber Factory All rights reserved

Polyester Staple Fiber Manufacturers

Friendship link - Anhui Fulin Environmental Protection Technology Co., Ltd.:https://www.ahflhb.com